Given my recent trading access to the Taiwan Stock Exchange, I was excited to run my cheap-stock Geiger counter over the market to see what might chirp back. One fascinating story is Top Bright, which announced last October that they were listing one of its divisions to trade A-shares on the Shenzhen Stock Exchange. Of particular note is that Top Bright announced they would not participate in the offering – which resulted in Top Bright’s equity interest in the division declining from 92% to 69%. After working through some of the details on the announcement, I had to rub my eyes a few times to make sure I wasn’t missing something: Top Bright has a market cap of $169M (USD) and their division has a market cap of $682M (USD) – valuing their 69% interest at $470M (USD). Needless to say, I decided to dig deeper and verify the facts as best I could.

Based in Taiwan, Top Bright operates through two divisions. Established in 1968, the Weighing segment, under the brand name T-Scale, manufactures scales used in retail/commercial, industrial, research, and medical applications. Half of the division’s revenue is from the retail/commercial (e.g., scales used in grocery stores) and one-third of revenue is from industrial uses (e.g., scales used in warehouse & shipping). The gross profit margin for the division is around 30%. Half of the division’s business is done in Europe with the remaining half done in America (20%), China (15%), and Asia (15%). Short-term operations in this segment have been relatively weak.

Established in 2000, the Materials segment manufactures EMI shielding materials in the form of tapes, foams, films, and meshes used in electronic devices to protect signals from being disrupted by external electromagnetic signals as well as prevent generated signals from interfering with surrounding components. The applications for these types of products are more or less endless, with 5G and the automotive industry cited as high-level drivers for demand in the industry. How this manufacturing know-how relates to Top Bright boils down to them being a component supplier to Apple MacBooks and iPads. Apple is by far their largest customer – contributing 70% of segment revenue. Gross profit margins are around 50% – 60%, but were 46% in the most recent quarter.

In November 2017, Top Bright began trading in Taipei via an IPO of 51.75 million shares. Diluted outstanding shares sit today at 51.97 million shares, (better than last year’s diluted share count of 55.35 million due to convertible bonds), with free float at 13.1 million. Insiders have a vested interest as the Chairman, Ching Hsuan Fu, holds over 32% of the share count; other directors have a combined interest of 19%. On March 24, they announced a dividend of T$2.00 payable on August 18 and a special dividend of T$2.00 payable on October 1.

Although revenue has nearly doubled since their IPO with retained earnings growing 24% annualized for the past 5 years, price-to-book has trended in the opposite direction culminating in 0.7x book following the “recapitalization” of the balance sheet post-Chinese offering.

The EMI business, a.k.a. the Apple segment, is run essentially through Long Young Electronic (Kunshan) Co., Ltd. — a Chinese-based operation in Kushan, known colloquially as “Little Taipei”. In October 2022, Long Young announced a private placement of 70.9 million A ordinary shares through a capital increase for gross proceeds of CNY $1.6 trillion. As mentioned, because Top Bright did not participate in the private placement they gave up more than 20% ownership in the dilution. In return, they garnered about T$6.6 billion – using some of the proceeds to retire approximately T$500 million in convertible notes. Overnight, cash & ST investments went from T$3 billion to T$9 billion and equity increased by T$4 billion.

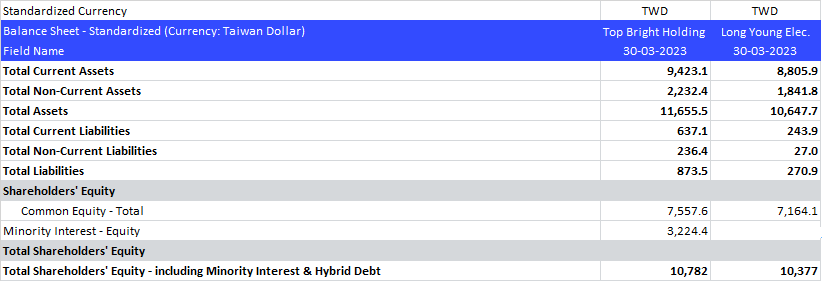

Like a game of hot potato, it’s difficult to sort through where the assets are located. Because Long Young is 69% owned by Top Bright (via LY International), assets are consolidated on Top Bright’s balance sheet with a contra account for the minority interest, (I assume minor discrepancies here are due to the TWD conversion). Given the level of assets located in Long Young, Top Bright acts almost like a shell company.

Growth at Long Young has been strong. When Top Bright was listed in 2017, segment revenue was roughly 50/50. Today, the EMI business is around two-thirds of its revenue. However, growth has slowed recently – which has probably put downward pressure on Top Bright’s market cap.

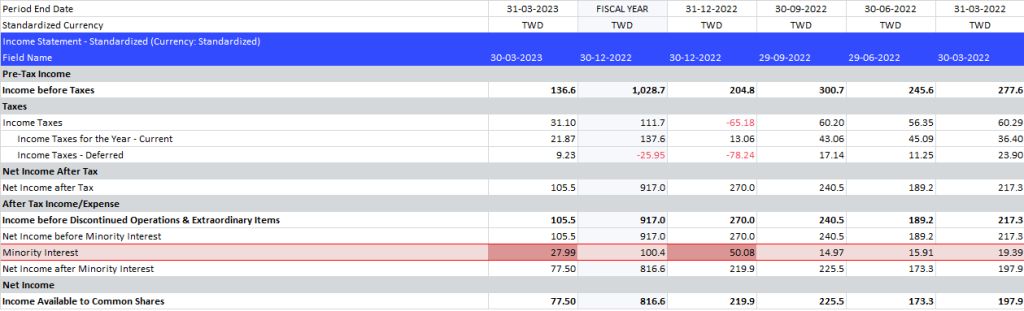

To add to the potential downward pressure, although Top Bright had a significant bump in equity, it is now facing some year-over-year comparable headwinds due to the equity-method accounting for the now 30% minority interest.

The near-term slowdown in the EMI segment along with the bad year-over-year comparables are putting downward pressure on the stock. However, the Shenzen market feels quite differently: putting a trailing 30x multiple on 70% of Top Bright’s earnings. In Taipei, Top Bright trades at a trailing 8x multiple. For those with access to Shenzen, a long/short strategy is worth considering. A discount to book equity and a discount to Top Bright’s liquidation value provides downside support.

Risks include of course the concentration of key customers. The China-Taiwan conflict is an issue, but one that may be overblown in the West. Also of key note: in May, Long Yong announced a proposal for issuing convertible bonds up to $160 million (USD) to be appropriated for a construction project for composite copper foil production in EMI shielding.

Disclosure: We own shares in Top Bright Holding Co Ltd (8499.TW). Leaven Partners, LP may hold any securities mentioned on this blog and may buy or sell these securities at any time.

the valuation differences themselves may not be so decisive. There are some companies that have a double listing in Hong Kong and Shanghai. This can lead to very different prices in these two locations. So far, however, these differences have not been significantly equalised.

LikeLike

Hi Mike, yes, I agree. Dual-listed firms’ H shares currently trade at a 27% discount, on average, to their mainland China-traded counterparts. In this particular case, the divergence was so extreme I had to make note of it.

LikeLike

a list of stocks with the highest discounts can be found here. http://www.aastocks.com/en/stocks/market/ah.aspx?sort=5&order=1&filter=3

One conceivable strategy could be to buy the stocks with the highest valuation differences in Hong Kong. However, I do not know if such a strategy works.

LikeLike

Yes it’s possible that it would be a strategy worth looking at, but since I can’t trade A shares it’s not something I’ve really thought about. But it may be difficult, due to: (1) The A shares and H shares are not convertible, (2) it is difficult to sell short individual stocks in the A-share market from what I know, and (3) converting Chinese yuan to a foreign currency (or HKD) may be difficult.

For additional thoughts:

Click to access A-H.pdf

AH Premium Index (when the index is below 100, Chinese A shares are cheaper. In 2013 and 2014, the index reached 90):

https://www.hsi.com.hk/eng/indexes/all-indexes/ahpremium

LikeLike

I think the only possible approach could be to buy cheaply valued H shares, which at the same time have a high discount to the corresponding A share. Top Bright Holding Co is actually an example of this.

LikeLike

Yes, I think there’s a lot of truth in that. And although Top Bright does not have an AH dynamic, it does seem to have similar traits.

0.7x book and growing book quite rapidly is the main interest for me. But that they raised capital priced at 30x earnings when those same earnings are priced at 7x earnings in Taiwan, I found to be intriguing.

LikeLike